In late 2020, Huawei faced a fight for survival in the mobile phone industry. The Trump administration’s sanctions had severed its access to global semiconductor supply chains, leaving the company unable to procure chips for its advanced handsets. To navigate this crisis, Huawei took a risky gamble, placing its $67 billion chip and mobile business in the hands of Semiconductor Manufacturing International Corporation (SMIC), a state-backed foundry striving to rival leading chipmakers.

Despite facing significant hurdles, including being added to the US sanctions list, SMIC endeavored to produce a new smartphone “system on a chip” called Charlotte. Nearly three years later, in August 2023, Huawei quietly unveiled the Mate 60 series phone, powered by the Kirin 9000S chip, formerly known as Charlotte. Despite challenges, the Kirin 9000S offered performance comparable to Qualcomm’s chips, sparking enthusiasm among Chinese consumers.

However, confusion lingered in the US about how Huawei circumvented sanctions to produce these chips. While the details remain undisclosed by Huawei and SMIC, interviews with industry insiders shed light on the extensive efforts and state support involved in this endeavor. The success of the Kirin 9000S raises questions about China’s ability to compete globally in the semiconductor industry amid geopolitical tensions. Most sources interviewed for this article requested anonymity due to the sensitivity of the semiconductor sector.

Less efficient machines

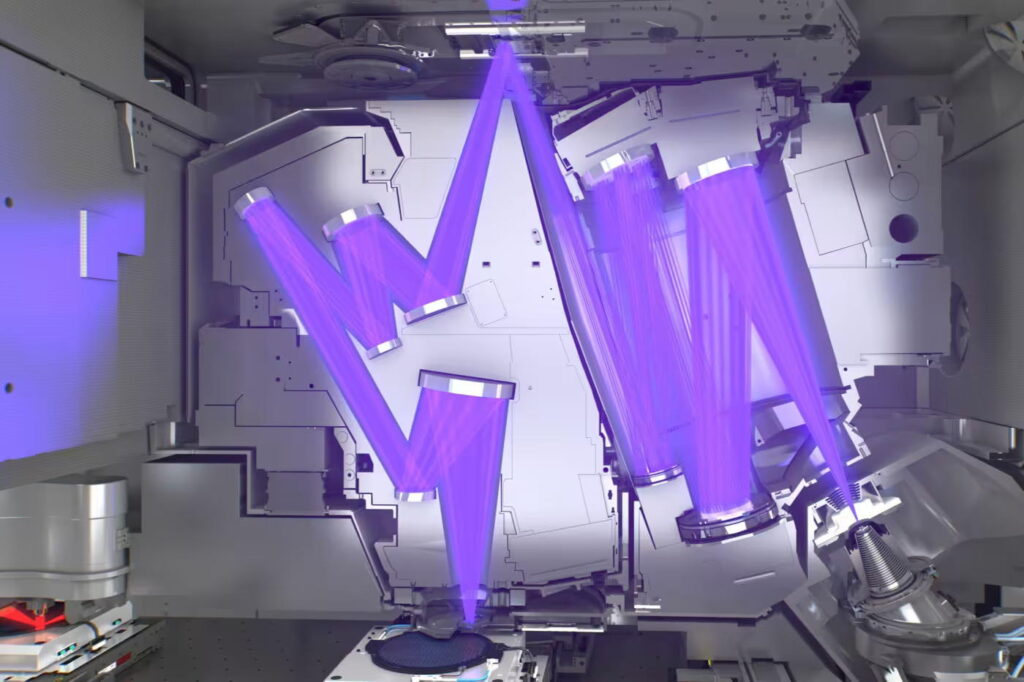

One of the key aspects in chip fabrication is the nanometer scale, with 7 nanometers being a benchmark for cutting-edge technology used in high-performance chips for smartphones and data centers. While companies like TSMC and Samsung utilize extreme ultraviolet (EUV) lithography equipment for chip production, Semiconductor Manufacturing International Corporation (SMIC) employs less efficient deep ultraviolet (DUV) machines. This choice was initially due to budget constraints and SMIC’s lagging technology compared to TSMC.

Lithography is critical in chip manufacturing, with advanced machines offering higher resolution for smaller chips. EUV lithography is more efficient and precise than DUV, resulting in less waste. However, SMIC had to resort to DUV machines, repeating chipmaking steps to increase transistor density. This adversely affected yield rates, increasing production costs and lowering yields compared to EUV.SMIC’s EUV equipment order from ASML was blocked in 2019 due to export controls, leaving SMIC to rely on existing equipment and supplies.

Despite challenges, SMIC managed to keep its 7 nm production line operational, albeit without additional support from ASML. Some speculate that SMIC obtained equipment in violation of export controls, with US officials expressing surprise at SMIC’s ability to maintain operations despite sanctions.Applied Materials, a US semiconductor equipment manufacturer, is under investigation for potential export control violations. While the company stated its commitment to compliance, it did not respond to requests for comment.

At any cost

Chipmakers often collaborate with design companies to test equipment and processes in new facilities. For instance, TSMC partners with Apple for its 3 nm processing line. Huawei served as the testing ground for SMIC’s upgraded 7 nm production, bringing revenue and refining production processes significantly. SMIC also enlisted experts from Taiwan, Japan, South Korea, and Germany to enhance productivity, leveraging their advanced process knowledge. Despite challenges, including adapting designs to different foundries, Huawei and SMIC managed Kirin 9000S production.

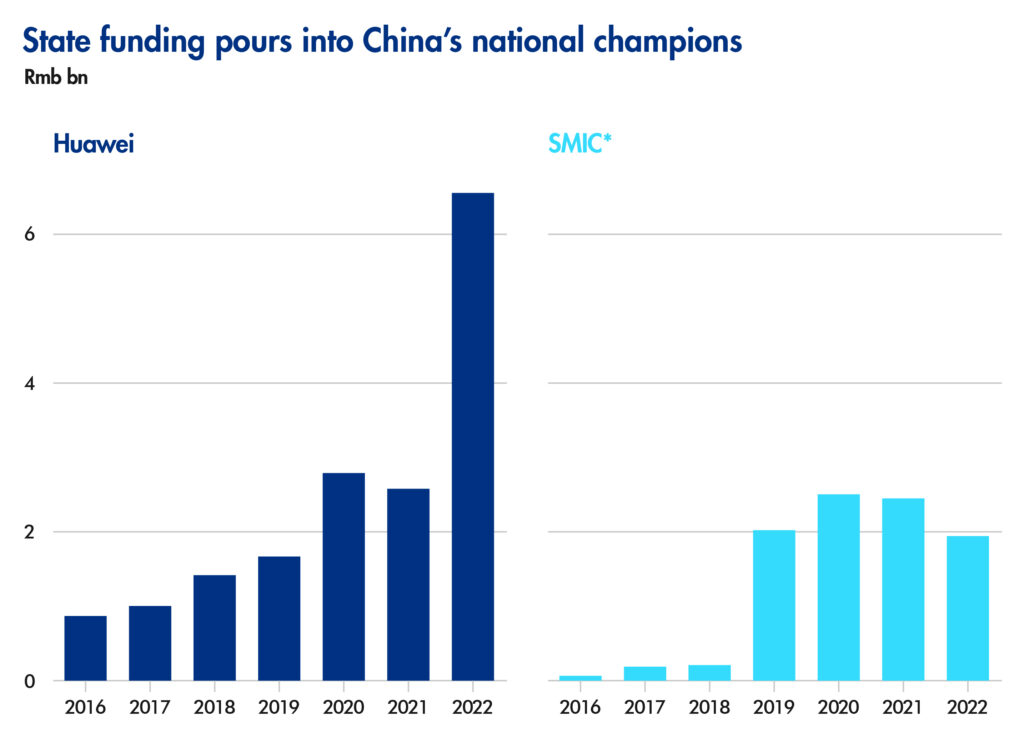

While production yields remain undisclosed, industry insiders suggest yields exceeding 30 percent during the volume production phase. This success came at a cost, with production expenses doubling compared to ideal benchmarks. Chinese state funding, exemplified by substantial subsidies to Huawei and SMIC, mitigated these costs. Douglas Fuller, a China semiconductor expert, notes the state’s commitment to investing in semiconductor advancement.

Next stop, AI

The Kirin 9000S has revitalized Huawei’s presence in China, with forecasts predicting a surge in Kirin-based smartphone production by the end of 2024. In response to tightening US restrictions on high-performance chip sales to China, Huawei and SMIC are expanding their chip production for artificial intelligence systems. Chinese tech giants like Tencent and Alibaba are exploring local alternatives due to difficulties in sourcing high-performance chips. Huawei’s Ascend series AI chips are positioned as potential replacements for Nvidia GPUs, with newly designed data center chips now manufactured by SMIC. Internet giants Tencent, Baidu, and Meituan have initiated trials with Huawei’s Ascend 910b chips.

Despite ambitions, challenges persist, notably low production yields for data center chips and equipment restrictions imposed by the US, Japan, and the Netherlands. While SMIC received advanced DUV machines from ASML before export controls tightened, concerns linger regarding equipment maintenance and material supplies. Industry experts warn of potential disruptions if stockpiles deplete before domestic alternatives emerge. Huawei and SMIC have not commented on these developments.

National champions

State support for Huawei and SMIC is assured as they strive to keep pace with industry leaders. Government officials emphasize the imperative to establish cutting-edge chip production lines “at all costs” to secure a stable chip supply chain, essential for China’s high-performance computing industry amid ongoing trade tensions with the US. Beijing’s investment in the microchip industry, spearheaded by the China Integrated Circuit Industry Investment Fund, has amassed $47 billion over the past decade, with plans to raise an additional $41 billion. A substantial portion of the $290.8 billion poured into semiconductor-related sectors in 2021 and 2022 by provincial governments focuses on semiconductor equipment and materials, aiming to reduce reliance on imports and strengthen China’s position in the global supply chain.

The endeavor aligns with national security interests, as articulated by the State Security Ministry, emphasizing the need for self-reliance in core technologies to safeguard economic and defense interests. Huawei and SMIC, crucial players in this endeavor, epitomize China’s ambition to assert technological independence. The successful launch of the Kirin 9000S underscores this ambition, with chip start-ups witnessing increased funding. Huawei’s aspirations extend beyond domestic markets, as reflected in the use of American city names for internal semiconductor projects, symbolizing the company’s aspiration to regain prominence in the global supply chain.

In conclusion, the emergence of the Kirin 9000S chip as a symbol of resilience and innovation highlights the transformative potential of strategic partnerships and indigenous capabilities within the semiconductor industry. Huawei and SMIC’s success in navigating geopolitical challenges and technological constraints underscores China’s ascent as a technological powerhouse. As they forge ahead in the pursuit of technological sovereignty, their journey serves as a testament to the enduring spirit of innovation and the quest for self-reliance in an increasingly interconnected world.

Source:

Financial Times: How Huawei surprised the US with a cutting-edge chip made in China

I read somewhere that China is using Graphene to make super-chips. I don’t know what is Graphene, can you provide some information about Grephene? Thank you.

Thank you, User 007, for entrusting our team with your question. We very much hope the following answer will satisfy your curiosity.

https://savytoday.com/graphene-miracle-material-that-will-change-the-world/